Mobile Pay

A secure and easy way to pay.

A secure and easy way to pay.

Just tap and go!

A secure and easy way to pay.

Tandia is pleased to offer the latest in payment technology for everyday purchases. Forget about pulling out your Tandia MEMBER CARD® debit card – mobile pay is a fast, simple way to make contactless payments.

Use your eligible smartphone, smartwatch or tablet to quickly pay for your purchases wherever tap payments are accepted. Just open your Samsung wallet / Google Wallet App on your device and add your card – it’s that easy.

Just look for where the Apple Pay logo is displayed and know you can pay for your purchases easily and securely in a few simple swipes. Using the Tandia™ Mobile app, you can add your Flash-enabled Tandia debit card to your iPhone or Apple Watch for purchases on-the-go. Using Apple Pay is as easy as holding your finger to the home button of your iPhone or using Face ID on iPhone X. You can also use Apple Pay on your iPad or Mac for online purchases where Interac® Debit is accepted for payment.

Each payment requires your authorization through either Touch ID, passcode or Face ID, keeping each transaction private and secure. Your card details are not stored on your device nor shared with the merchant during a transaction. You will get notifications for both successful and declined transactions.

Your spending limits for Apple Pay purchases are the same as those on your Tandia debit card. If your device is lost or stolen, you can remotely suspend Apple Pay or wipe your device.

To learn more about setting up Apple Pay visit the Apple website.

Using your iPhone, hold it to the payment terminal with your finger on the home button. A beep and vibration will confirm your payment.

For your Apple Watch, hold the watch to payment terminal and double click the side button. A tap and a beep will confirm your payment.

*Apple Pay works with iPhone 6 and later in stores, apps and websites in Safari; with Apple Watch in stores and apps (requires iPhone 6 or later); with iPad Pro, iPad (5th generation), iPad Air 2, and iPad mini 3 and later in apps and websites in Safari; and with Mac (2012 or later) in Safari with an Apple Pay-enabled iPhone or Apple Watch. For a list of compatible Apple Pay devices, see support.apple.com/km207105

Apple, the Apple logo, Apple Pay, Apple Watch, Face ID, iPad, iPhone, Mac, Safari and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. iPad Pro is a trademark of Apple Inc.

®MEMBER CARD is a registered certification mark owned by the Canadian Credit Union Association and is used under license.

®Trade-mark of Interac Inc. Used under license.

Google Pay is the fast, simple way to pay on sites, in apps and in stores using cards that are saved to your Google Wallet. It protects your payment info with multiple layers of security and makes it easy to send money, store tickets, or cash in on rewards - all from one convenient place.

When you pay in shops, Google Pay doesn't share your actual card number, so your information stays secure. Plus, you can check out faster with the device that's already in your hand - no need to dig for your wallet.

For more information on how to set-up, please click here.

Making everyday purchases is fast, more secure and convenient with Samsung Pay. Simply swipe up from the home button and access your Tandia Member Card® debit card. Purchases can be authenticated with your PIN, iris or fingerprint* before tapping your Samsung phone over a POS terminal. Your information is further protected with network tokenization technology, remote disabling options and security measures set by Tandia.

Use your Tandia debit card at most merchant terminals where you can tap, scan or swipe a payment card. Samsung Pay - discover a new way to pay.

Using Samsung Pay is simple. Get started by selecting the app icon or by swiping up from the bottom of your screen. Authenticate your identity easily using your iris or your fingerprint, or just enter your PIN. To purchase, simply hold your Samsung phone over any POS terminal accepting payment cards that tap, swipe or scan.

To load your card on your Samsung mobile device:

1. Open the Samsung Pay app on your Samsung mobile device.

2. Tap the plus sign in the upper right corner.

3. Follow the instructions to add your Tandia debit card.

You can now use your Samsung mobile device to make in-store payments with your Tandia debit card.

To make a purchase:

1. Open your Samsung Pay app.

2. Select your Tandia debit card.

3. Authenticate your card with your PIN, fingerprint or iris scan.

4. Hold your device to the payment terminal - a subtle vibration and beep will confirm your payment and the screen will show a checkmark with a 'Payment completed' message. The payment terminal will also let you know when the payment is approved.

*Iris and fingerprint scanner compatible devices. Please check your device settings for compatibility.

**Works anywhere MST/NFC credit transactions are accepted.

©2017 Samsung Electronics Canada Inc. All rights reserved. Samsung and Samsung Galaxy are registered trademarks or trademarks of Samsung Electronics Co., used with permission. Screen images simulated.

®INTERAC is a trademark owned by Interac® Inc. and is used under license.

®MEMBER CARD is a registered certification mark owned by the Canadian Credit Union Association and is used under license.

™Tandia is a registered trademark of Tandia Financial Credit Union Limited.

Which Tandia cards can I use with Apple Pay?

Tandia Member Card® debit cards are currently available. Apple Pay will use the same default account (CHQ/SAV) that you use for Interac® Flash purchases.

Can I add my Tandia debit card to more than one Apple device?

Yes, you can add your card to one or more eligible Apple devices.

How do I make my Tandia debit card the default card in Apple Pay?

The first card added to Apple Pay is automatically set to be the default card. To change your default card, open the Wallet app, hold and drag your Tandia debit card to the front. You may also:

a) Open Settings and select “Wallet & Apple Pay”

b) Select “Default Card” under “Transaction Defaults” and choose your Tandia debit card.

Is Apple Pay free?

Yes, there are no fees to use or register your card with Apple Pay. Each transaction in Apple Pay will count as a transaction, if transaction fees are applicable for your account. Your wireless carrier may charge additional fees for data usage.

How is Apple Pay secure?

Each payment requires your authorization through either TouchID, passcode or Face ID. Your card details are not stored on your device and won’t be shared with the merchant. If your device is lost or stolen, you can remotely suspend Apple Pay or wipe your device.

Is my account number stored on my phone?

No, your account number is replaced with a secure digital number known as a token. The token represents your Tandia debit card and is used to make secure purchases, in-app and in-store.

On which devices will Apple Pay work?

Apple Pay works on iPhone 6 or higher, or iPhone 5 if you have an Apple Watch.

Do I need network access to make a purchase?

No, a network connection is not required to make a payment, but it is recommended to receive transaction alerts.

How do I do a Refund?

Refunds are initiated by the Merchant at their POS terminal, following the same rules as refunds do today. It is recommended that you bring your physical card with you.

What if my device is lost or stolen?

If you have any reason to believe your Tandia debit card details used for Apple Pay have been stolen or compromised please call us at 1.800.598.2891. You can remove your card remotely using Apple’s “Find my iPhone”.

If I get a new Tandia debit card, do I have to update Apple Pay?

Yes, you will need to delete the previous card and add the new card.

Can I remove my card from Apple Pay?

Yes. To remove a card from Apple Pay: open settings, select “Wallet & Apple Pay”, choose “Select Card”, and then select “Remove Card”.

FAQ What is Google Pay?

Google Pay offers an easy, secure and convenient way to pay on Android devices. Google Pay will provide real-time notifications and details for your purchases when you use Google pay on your Android device.

Which cards and devices can use Google Pay?

All Collabria credit cards are available for use with Google Pay. To use Google Pay in-store, your Android software version must be Lollipop (5.0) or higher. To use Google Pay for in-app or website transactions, click the google pay button as a payment method.

Where can I use Google Pay?

You can use Google Pay to make payments:

• In stores with supported devices wherever contactless payments are accepted,

within apps and on the web in Safari

• In participating merchant apps

• On the web with supported devices

How do I pay with Google Pay?

Step 1: Wake up and unlock your phone. You don’t need to open Google Pay to make a payment, but you do need to have your phone screen on and your phone unlocked.

Step 2: Hold the back of your phone close to the terminal for a few seconds. If Google Pay sends the payment info, you’ll see a green checkmark. If you don’t see one:

Try holding your phone a different way.

Your NFC antenna could be near the top or bottom of your device.

Hold your phone closer to the terminal for a few extra seconds.

If you do see a checkmark, but the cashier says the payment didn’t work:

Double-check if the store accepts mobile payments.

Make sure your card information in Google Pay is up to date.

Step 3: Follow the on-screen instructions. When the payment goes through, follow the same instructions you would if you swipe your card. Debit cards: Enter the PIN you set up with your bank. This is different from the PIN you use to unlock your device.

How do I view my charges and transaction history?

To get details on transactions and charges made using Google Pay:

Open the Google Pay app.

Tap the card you used to pay.

Find and tap your transaction.

When making purchases at certain merchants, such as restaurants, hotels, and gas stations, you might see different transaction amounts from the final amount posted to your account. Refer to your account statement for final transaction details.

How do I return a purchase bought through Google Pay?

To return something you bought with Google Pay, you’ll need your store receipt, just like you would for any other purchase. If the merchant asks you to swipe your card, simply hold the back of your phone to the contactless payment terminal. For some returns, you might have to provide the last four digits of your virtual account number. You can find your virtual account number on the card details screen in your Google Pay app.

In some instances, a merchant may ask for your physical card to complete the return.

How does Google Pay keep my information safe?

Data protection: Your payment information is encrypted and stored on secure servers.

Virtual account numbers: Each payment card you add gets a virtual account number that merchants see when you buy. Your payment information isn’t shared with merchants.

Delete unused cards: If your device has been turned off, lost, or otherwise inactive in the last 90 days, then cards will be deleted for your security.

Screen lock: You’ll need to set up a screen lock on your device before you add cards. If you turn screen lock off, Google Pay removes your cards for your protection.

What do I do if my device is lost or stolen?

If your phone is lost or stolen, you can find, lock, or erase it using Android Device Manager. If you lock your device, Google Pay can’t be used. If your device can’t be contacted, your payment information might be removed so no one can access it. If you find your device, unlock it and add your payment information again to use Google Pay. Since Google Pay doesn’t store your card details on your phone, anyone who finds or steals your phone won’t be able to access that information even if it’s unlocked.

Is Samsung Pay available for both personal and business members of Tandia Financial Credit Union?

Samsung Pay is currently only available to Tandia members with a personal account who have Tandia Financial Credit Union MEMBER CARD® debit card.

Which devices can I use with Samsung Pay?

Samsung Pay is supported on the following Samsung devices: Galaxy S9 & S9+, Galaxy S8 & S8+, Galaxy S7 & S7 edge, Galaxy S6, S6 edge & S6 edge+, Galaxy Note9 / Note8 / Note5, Galaxy A8 / A5, Gear Sport, Gear S3 Frontier/Classic and Galaxy Watch.

Can I use Samsung Pay to pay for online purchases?

The ability to pay online with Samsung Pay and your Tandia debit card is only with select merchants.

How do I make my Tandia debit card my default card in Samsung Pay?

You can't set a default card in Samsung Pay. The last card used or viewed would be the card defaulted for payment. Swipe left and right to scroll through your payment cards and select the one you want to use for payment.

Can I add a second account or card to Samsung Pay?

Yes, you can have up to 10 cards in the Samsung Pay app.

How many devices can I add my card(s) to?

You can add your Tandia debit card to the Samsung Pay app on any number of Samsung devices.

What are the terms & conditions of my Tandia debit card in Samsung Pay?

Samsung Pay is governed in accordance with the terms and conditions that you accepted when you added your card to Samsung Pay and the Member Card Agreement that you signed when you received your card.

Why am I being asked to call Tandia Financial Credit Union?

Tandia treats the protection of your financial information very seriously. If you're asked to call us as part of the card activation process, it's because we need to verify your card to protect you from fraud.

Where can I pay with Samsung Pay?

You can use your Tandia debit card with Samsung Pay anywhere you see these three symbols.

Will I have to sign a receipt or enter a PIN when paying with Samsung Pay?

No, Samsung Pay purchases are verified using fingerprints, iris scans or PIN (personal identification number).

Is there a maximum dollar amount for a purchase?

Samsung Pay doesn't limit transaction amounts but individual retailers may. In Ontario, it's common to see limits of $100 per transaction.

Am I subject to a daily spending limit?

There is a daily spending limit attached to your Tandia debit card. This helps protect you from loss due to unauthorized use of your card. Any withdrawals you make from your account using your Tandia debit card will count toward this limit. This includes purchases at retail locations, ATM transactions and now Samsung Pay.

Is there a cost to using Samsung Pay?

No, Samsung Pay is free to use. However, each Samsung Pay payment will count as a transaction on your account. If you pay transaction fees on your account or you exceed the monthly transaction limit you could pay a fee for your Samsung Pay transactions.

How do I know when a purchase is complete?

Your transactions will show a checkmark with a "Payment completed" message.

Does Samsung Pay work internationally?

Samsung Pay using your Tandia debit card works wherever Interac® Flash is accepted. Currently, Interac Flash is only accepted in Canada.

How do I view recent Samsung Pay transactions?

To view your most recent transactions, open the Samsung Pay app and select the card you want to view the transactions for. Your mobile payment transactions will also show up on your monthly banking statement, the same as all other transactions made using your physical card.

Will I get a notification on my phone for a declined transaction?

Yes, you will get notifications for declined transactions, just as you would for successful ones. Check your account records for your current balance and transaction status.

Why does the transaction history on my phone not include purchases made with my watch?

Each device only displays transactions performed with that device, since the virtual "card number" on your watch is different than the "card number" on your phone. This security feature helps us to manage situations when a device (either the watch or the phone) is lost, stolen or upgraded.

How do I get a refund?

Refunds are initiated by the retailer at the payment terminal following the same process as a purchase, with one exception. The cashier may ask you for the last four digits of your Device Account Number. To find the last four digits of your Device Account Number for your card, tap the (i) or (...) button on your card in the Samsung Pay app to view the back of your card.

When you return a purchase made with Samsung Pay you will receive a refund to your account. Successful refunds will be processed immediately.

Is there an easy way to pay with another card?

Yes, to pay with another card open the Samsung Pay app and select that card before making your purchase. The card used last will be shown as the first option for your next transaction.

How do I stop using Samsung Pay?

Having a card with Samsung Pay does not block you from making purchases using your physical card. You always have the option remove your card from the Samsung Pay app.

How do I remove a card from the Samsung Pay app?

a) Open the Samsung Pay app

b) Tap Wallet and then select Credit/Debit

c) Select the card you want to remove and then touch the "..." (three dots at the top of the screen) for more options

d) Select Delete Card and then choose a reason for removing the card

e) Tap Delete and then authenticate using your PIN, fingerprint or iris scan.

Will removing my card deactivate my plastic card?

No, removing your card from the Samsung Pay app will only deactivate the card from being used for Samsung Pay. It will have no effect on your plastic card.

What should I do if Samsung Pay is not working with the payment terminal?

Samsung Pay should work at all retailers that accept Interac Flash. Depending on the location of the signal from the phone and the case you are using, you may need to either remove the case or re-position your phone on the payment terminal. Payment terminals also vary from store to store so what works at one may not work at another. If you have trouble, ask the retailer if they accept Interac® on Samsung Pay.

Do I need network access to make a purchase?

No. Your phone (powered and unlocked) has everything you need to complete a purchase at a retailer, whether or not you have network access at that time. As with card purchases, you may not be able to complete a purchase if the retailer’s payment terminal is offline or unavailable. You will need network access to receive transaction notifications from Samsung.

I’m having trouble with Samsung Pay. Who do I contact?

If you are having trouble using Samsung Pay, please call us at 1-800-598-2891 and we will be happy to answer your questions.

Will the case on my phone interfere with making purchases?

The Samsung Pay signal is a magnetic field created by a small antenna, which interacts with a similar antenna on the payment terminal. The case on your phone, depending on its thickness and material, could interfere with this signal. If you have trouble using Samsung Pay, try re-positioning your phone on the terminal and waiting up to a few seconds for the devices to communicate with one another. For some thicker phone cases, you may need to remove the case to complete a purchase.

How is Samsung Pay secured?

Each Samsung Pay transaction is protected by, and requires, your authorization using PIN, fingerprint or iris scan. Samsung Pay uses tokenization, a secure environment and Samsung KNOX to secure your payment information. Card information is encrypted and securely sent to the appropriate card network. Upon determining their card validity, account information, and device integrity, Interac sends a token to the device. The token is stored in the Trusted Execution Environment on the device, leveraging Samsung KNOX’s Architecture. No debit card information is stored on Samsung’s devices or servers.

Is additional information being collected from me when I use Samsung Pay?

Samsung Pay does not capture any transaction information that can be tied back to you. If you have location services turned on, the location of your device and the approximate date and time of the transaction may be sent anonymously to Samsung. View the Samsung Pay terms and conditions for more information.

What is NFC?

NFC stands for Near Field Communication, which is a contactless proximity technology. NFC uses the same technical standards as plastic cards (such as Interac® Flash), which allows you to tap your card to complete transactions. It is known for short range, secure transmission, with a maximum distance of less than 5-10 cm. In practice, phones need to be held very near to device readers for a few seconds to complete a transaction.

How does the technology work?

When you register a card with Samsung Pay, the card is assigned a digital identification number, which is encrypted and verified by Samsung and Interac – and protects your payment information.

How am I protected against fraud?

Each Samsung Pay transaction requires your authorization through PIN, fingerprint or iris scan. Your card number is not shared with the merchant nor saved on your device.

If you have questions or technical issues, please contact us and we would be happy to help! Everyone you speak with on the phone or contact by email lives in the communites we operate in and works local.

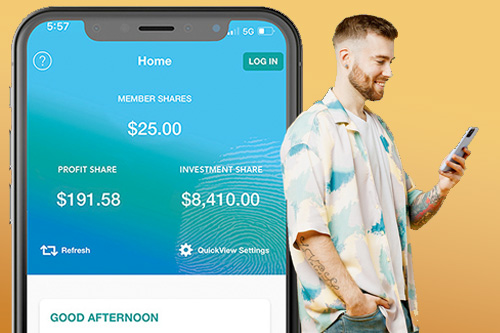

Tandia-to-go!

Take Tandia with you everywhere you go with our light, agile and newly updated mobile app. The new Tandia™ Mobile app takes mobile banking to the next level of fast, spacious and easy navigation on your smaller-screen devices. Whenever or wherever, you can.

If you like to pay with a credit card Tandia is here for you. We offer an outstanding suite of cards with competitive features and some very unique benefits and advantages.

Let Wealth by Tandia help you curate a long-term financial plan and investment portfolio that measures up to your unique financial goals. Whether you’re saving for the future, preparing to buy your first home, or thinking about protecting your estate, our range of Wealth Services can help you achieve the level of financial comfort you aspire to.

Let your family, colleagues and friends know about Tandia. Refer a qualifying new member and both of you will be cashing in through our Member Referral Program. Remember, the more members you refer to Tandia, the more you earn!

Get in touch with us at any time, whether it’s a question about our services or a comment on how we can do things better. Your voice is number one at Tandia.

To report a lost or stolen MEMBER CARD® debit card during regular business hours, call 1-800-598-2891 after hours please call 1-888-277-1043.